Do not misinterpreted this as stating every person should opt for one of these home loans. The issue is their rates of interest are normally higher than typical mortgages', as well as for many the added price of the home loan financial obligation greater than outweighs the gain on savings. For students that began university or college in 2011 or in the past, passion is set at the reduced of base price plus one percentage point, or the rate of rising cost of living, making it the least expensive feasible lasting financial obligation. It's possible, if rising cost of living is high and rate of interest are reduced, you might have a home loan that's more affordable than the trainee finance but over the long-term, that's not likely.

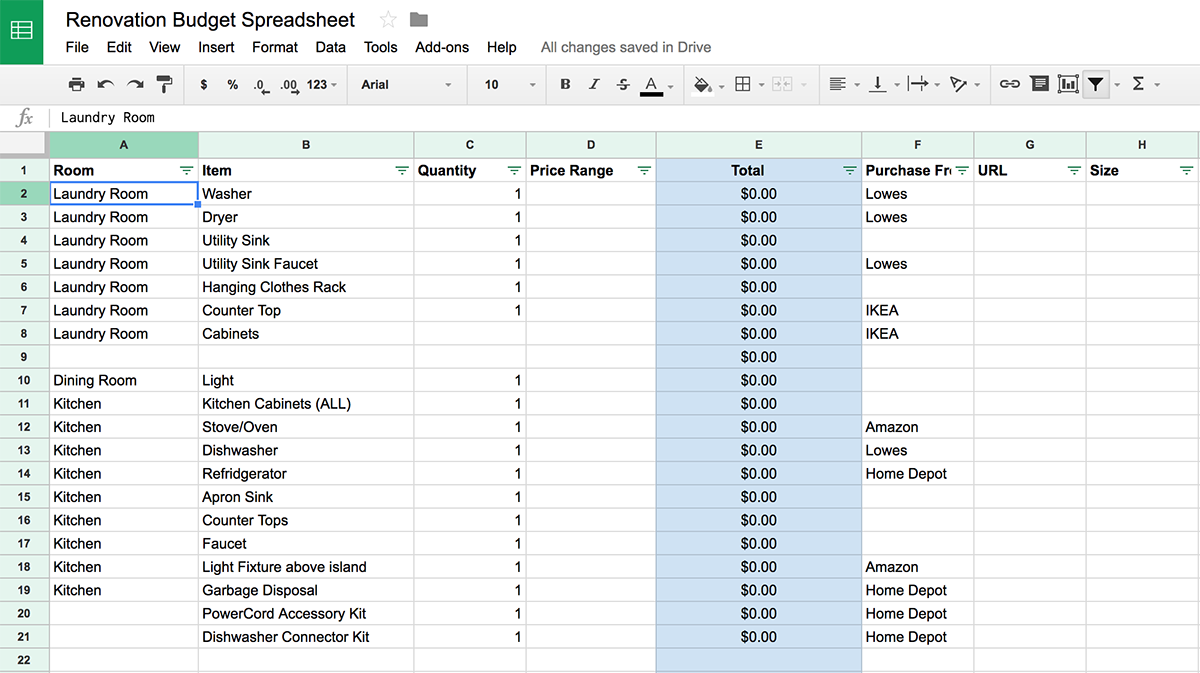

How much does it cost to gut a 1200 sq ft house?

Whole House Renovation CostSquare FeetTypical RangeAverage Cost1,200$18,000 – $72,000$24,0001,500$20,000 – $85,000$30,0001,800$25,000 – $100,000$45,0002,000$28,000 – $115,000$50,0005 more rows

Jumping right into renovating job - without establishing a budget plan - is not a sensible decision. In fact, you may invest loads of money on nice-to-have or unneeded updates that you will not make money back for on for years to find. That's why you require to be mindful when planning to renovate your house.

Whatever suggests you make a decision to use for the job, home makeover can be rather expensive at times. Hence, the best method to start your job is to take into consideration renovating rooms that are functionally obsolete.

Can a first time home buyer Have a peek at this website get a conventional loan?

It's possible for first-time home buyers to get a conventional mortgage with a down payment as low as 3%; however, the down payment requirement can vary based on your personal situation and the type of loan or property you're getting: If you're https://telegra.ph/bq-is-the-most-affordable-shop-to-acquire-a-cooking-area-for-3rd-year-operating-09-24 not a first-time home buyer, the down payment requirement is 5%.

Should I Overpay My Mortgage Every Month Or Ask My Loan Provider To Formally Decrease The Term?

Can I remortgage to pay off debt?

Remortgaging to pay off debt. If you're a homeowner remortgaging can, if the right mortgage is found, improve your situation. You can release the equity that's in your property in a lump sum and use this to repay your other debts. It might reduce your monthly mortgage payment, freeing up money to repay your other debts.

- Whatever means you determine to use for the project, residence renovation can be quite costly sometimes.

- Making use of the cash Visit this site you launch from your house to pay off various other financial debts can assist because home mortgages usually have a reduced rates of interest than individual lendings and also charge card.

- Hence, the very best means to start your project is to take into consideration redesigning areas that are functionally out-of-date.

- Do you have cash saved up or do you need a building car loan for the task?

- By remortgaging you can release a few of this equity and utilize the cash as a down payment on a buy to let building.

- This will be cheaper than getting a certain buy to let home mortgage due to the fact that rate of interest are greater for buy to allow loans.

As you browse renovating your initial or next job without spending any type of cash, remember you do not desire it to look like you really did not invest any kind of cash. This can conveniently be done by spending the time to ensure improvements are done appropriately the first time. Pay attention to the details, and stay clear of mistakes, such as crooked paint lines, or door manages not screwed in all the way that can be awkward as well as expense you a prospective house purchaser. Remodeling with no cash is an art in and of itself that should have equivalent quantity of interest regardless of the dimension of the spending plan.

Making use of the money you release from your house to settle various other financial obligations can aid due to the fact that home mortgages usually have a reduced rates of interest than personal financings and charge card. By remortgaging you can release several of this equity and make use of the money as a deposit on a buy to allow property. This will be less costly than obtaining a certain buy to let mortgage since rate of interest are greater for buy to allow lendings. If an FHA rehab home loan isn't for you, consider Fannie Mae's HomeStyle Improvement home loan.

The Majority Of Can Pay Too Much 10% Each Year, However Inspect Obtain It Wrong As Well As You Risk ₤ 1,000 S In Fees.

If you're overpaying your home loan, you don't simply get the benefit of paying rate of interest on a smaller sized quantity of financial obligation. Once the calculator informs you what cost savings rate you need, check out theTop Financial savings AccountsorTop Cash ISAguides to see what's presently offered. For the large majority of people, making additional home mortgage repayments wins. The new personal financial savings allowance means every basic-rate taxpayer can gain ₤ 1,000 passion without paying tax obligation on it (higher rate ₤ 500). To work out whether you must overpay you need to see if your mortgage rate is greater than the after-tax price on your cost savings.